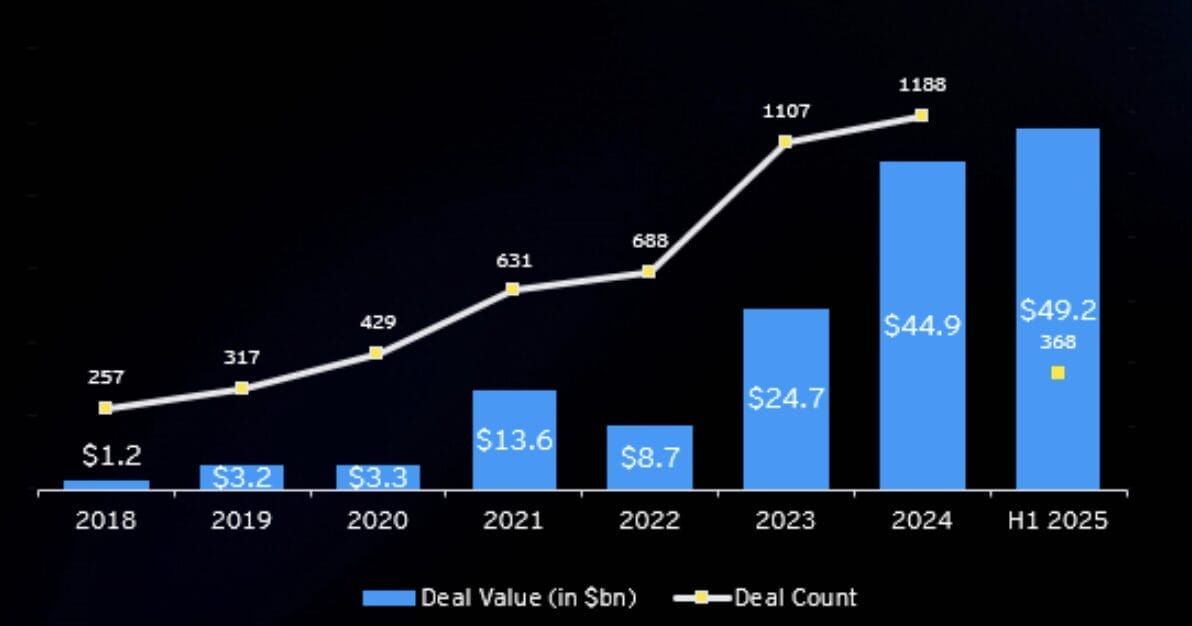

Global venture capital (VC) investment in generative artificial intelligence (GenAI) surged to $49.2 billion in the first half of 2025, outpacing the total for all of 2024 ($44.2 billion) and more than double the total for 2023 ($21.3b), according to EY Ireland’s latest Generative AI Key Deals and Market Insights study.

The sharp rise in overall deal value comes despite a near 25% drop in the number of transactions for the first six months of 2025 versus the second half of 2024, as VC firms concentrate on more mature, revenue-generating AI companies, resulting in fewer but significantly larger deals. Average transaction size for late-stage deals more than tripled to more than $1.55 billion, up from $481 million in 2024, while early-stage VC rounds declined, and angel and seed rounds saw no change.

A wave of high-value investment into some of the most established players has underpinned this record first half of the year, including SoftBank’s commitment to OpenAI which could reach $40 billion, xAI’s $10 billion funding round, and major investments in Databricks ($5 billion), Anthropic ($3.5 billion), Mistral AI ($600 million), and Harvey ($600 million). Additionally, Agentic AI – which enables systems to perceive, decide and act autonomously – has emerged as a key growth area.

Capgemini’s $3.3 billion acquisition of WNS and Berlin-based Parloa’s $120 million raise, propelling it to a $1 billion valuation, are among the notable deals in this area. While not covered in the data for the first half of the year, the recent acquisition of Irish predictive media analytics firm NewsWhip by Sprout Social is a welcome boost to the local sector.

Commenting on the findings Grit Young, EY Ireland Techology, Media and Telecoms Lead said:

“GenAI continues to reshape the investment landscape at an extraordinary pace. The first half of 2025 has already surpassed last year, which was also a high-water mark. That momentum is expected to continue and build further into the second half of the year with the launch of new GenAI platforms and their faster revenue generation capabilities.

“While there was substantial concern at the start of the year with the launch of DeepSeek that investment in GenAI was likely to trend downwards, the results for the first half of the year point to a very different scenario. We are seeing a clear pivot to fewer but more substantial investments, which are pointed towards more mature companies and platforms that can demonstrate they can deliver real-world impact and return on investment.

This growth is being fuelled by rising adoption across industries, high demand for sector-specific solutions and continued innovation in AI hardware, particularly semiconductors.

“GenAI is entering a new phase, and the scale of investment reflects growing confidence in its commercial potential. The recent results from the ‘Magnificent Seven’ underscore how rapidly this technology is being adopted by customers, and we would expect that the investment trajectory is likely to accelerate through the second half of the year and beyond.

“It would appear that GenAI has skipped through the traditional ‘trough of disillusionment’ for new technology adoption quite quickly and has now moved into another upswing cycle.”

Opportunities remain for Ireland

Ireland has emerged as a strong adopter of AI, with 63 per cent of startups using the technology and 36 per cent embedding it at the core of their business models. However, many AI startups are struggling with access to capital and infrastructure.

Grit Young says: “In Ireland, the appetite for AI adoption is strong, and we are working with many indigenous and international companies who are already well established on their AI journey. However, for AI startups, the funding environment remains challenging, particularly in the €1 million to €10 million funding space.

“Many high-potential startups find themselves in a difficult middle ground, too advanced for early-stage support, yet not quite large enough to attract global VC attention. However, Ireland has a deep and well-established pool of talented entrepreneurs, and with increased collaboration between businesses, founders, academic institutions and policymakers, there are plenty of opportunities to be seized.”

US dominance increases, the Middle East is growing in importance, while China remains an unknown

The research underscores the growing divide between the US and the rest of the world when it comes to GenAI investment. American-based firms accounted for 97 per cent of global GenAI deal value in the first six months of the year, with Europe, the Middle East and Africa (EMEA) trailing at just 2 per cent despite maintaining a steady number of deals. In China, the government is investing significantly in AI, as is local capital; however, the quantum of investment is difficult to track.

Capital from the Middle East is playing an increasingly prominent role in shaping global deal flow, continuing a trend that gathered pace in 2024. Saudi Arabia, in particular, has been ramping up its investment in AI and GenAI, with the Public Investment Fund (PIF) backing both domestic initiatives and international ventures as part of its strategy to position the Kingdom as a regional technology hub.

Grit Young says: “US dominance in GenAI innovation and investment is widening, with deal activity increasingly concentrated in North America. This imbalance is stark: of 39 recognised AI unicorns globally, 29 are in the US, compared to just three in Europe and two in Israel.

“With increased regulatory divergence on AI between the US, Europe, China and beyond, it will be important for Europe to balance essential regulation with supporting and enabling innovation.”

Innovative platforms, corporate partnerships spur funding

The EY Ireland report points to a clear shift in investor focus towards GenAI platforms offering specialised, real-world applications. Venture capital is increasingly flowing into companies building software on third-party foundation models, with use cases ranging from cybersecurity to regulatory compliance.

Among the standout launches in 2025 are Acuvity’s RYNO, a GenAI security platform designed for adaptive risk management, and Integreon’s compliance service, which leverages AI to address frameworks such as GDPR and DORA.

Fig 1: GenAI VC Investments, 2018 – June’25 by Deal Volume and Value